graph TD

A[⚠️ CRITICAL NOTICE: RESEARCH AGENDA — NOT PRODUCTION-READY]:::warning

B[This is a RESEARCH AGENDA, not a production-ready protocol.

Do NOT deploy to mainnet before Q3 2026 and security audit.]

subgraph Includes[✅ This paper includes:]

C1[• Honest uncertainty]

C2[• Testable assumptions]

C3[• Go/no-go gates]

C4[• Fallback strategies]

end

subgraph Excludes[❌ Does NOT include:]

D1[• Production code]

D2[• Security audit]

D3[• Formal proofs]

D4[• Mainnet launch date]

end

A --> B

B --> Includes

B --> Excludes

classDef warning fill:#fff3cd,stroke:#ffc107,stroke-width:2px,color:#000,font-weight:bold

classDef includes fill:#d4edda,stroke:#28a745,stroke-width:1px,color:#155724

classDef excludes fill:#f8d7da,stroke:#dc3545,stroke-width:1px,color:#721c24

class A warning

class Includes includes

class Excludes excludes

Document Status:

Last Updated: November 21, 2025

Next Major Update: Q2 2026 (post-pilot empirical data)

Target Pilot Sectors:

- Grants DAOs (Primary): Validates high-conflict scenarios (40-45% conflict rate)

- Identity Protocols (Secondary): Tests low-conflict edge case (5-10% conflict rate)

Authors: Ramsyana (ramsyana@mac.com)

Date: November 21, 2025

Version: 1.5 Draft (Revised Nov 21, 2025 - Priority 1-4 & Quick Wins Implementation)

License: MIT License (open-source for forking and contribution; see Appendix).

Problem Statement: DAOs serialize governance decisions, forcing proposals to wait weeks for manual conflict resolution.

Solution: Reacxion Protocol eliminates the technical bottleneck in conflicted proposal resolution. Its core innovation is semantic parallelism: DAOs can test conflicting proposals simultaneously instead of waiting weeks. It enforces a mandatory 24-hour social discussion period, then reduces technical execution from 12-18 days to ~2-10 seconds. This enables a 3–5× realistic end-to-end governance speedup for typical proposals. In best-case scenarios (short, low‑coordination proposals), Reacxion can approach ~16× end-to-end improvement by parallelizing conflicting proposals and resolving them via deterministic VDF-ordered tournaments.

Transparency & Research Commitment: We commit to publishing all pilot data (Q1-Q2 2026) under CC-BY-4.0, including negative results. If core assumptions (conflict rates, VDF performance, validator recruitment) are falsified, we will publish findings and recommend protocol sunset or redesign.

Speedup Components:

- Social consensus phase: 1-7 days → 24h minimum (human process)

- Technical execution: 12-18 days → ~2-10s (Technical Execution Speedup)

- Full E2E cycle (for proposals whose social consensus can reasonably conclude within ~7 days): 8–21 days → ~1.5–4 days (3–5× typical E2E improvement, includes 24h gossip floor; ~16× is a best-case envelope for short, low-coordination proposals). Complex governance with multi‑week or multi‑month debate remains dominated by human coordination and may see only 2–3× end‑to‑end improvement.

Core Innovation: Reacxion reframes DAO governance as a git-like workflow: fork competing ideas, merge non-conflicts automatically, referee clashes via deterministic timestamps. This could potentially accelerate organizational learning rates, not just voting speed. The protocol is targeted at mid-scale DAOs ($1M-50M TVL) for Tier 1 governance (parameter tweaks, <$10M impact), assuming ≤20% adversarial control.

Transparency & Research Commitment: We commit to publishing all pilot data (Q1-Q2 2026) under CC-BY-4.0. If assumptions prove incorrect, we will transparently update the protocol design. See Section 1.11 for explicit unknowns and [TBD] for live validation progress.

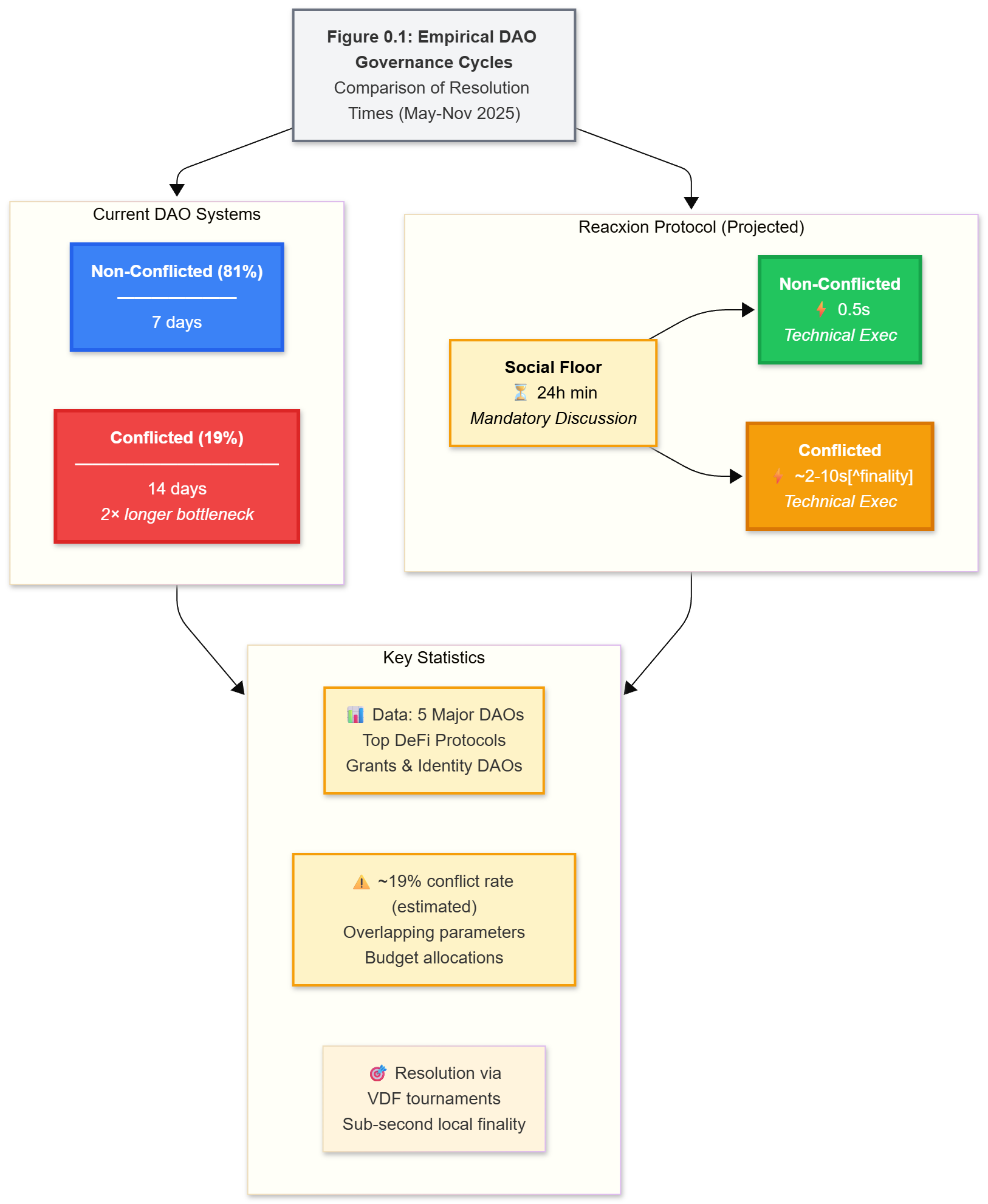

Figure 0.1: Empirical DAO Governance Cycles

Figure 0.1: Raw Mermaid Empirical DAO Governance Cycles

%%{init: {'theme':'base', 'themeVariables': { 'fontSize':'14px'}}}%%

graph TB

Title["<b>Figure 0.1: Empirical DAO Governance Cycles</b><br/>Comparison of Resolution Times (May-Nov 2025)"]

subgraph Current["Current DAO Systems"]

direction LR

NC_Current["<b>Non-Conflicted (81%)</b><br/>━━━━━━━<br/>7 days"]

C_Current["<b>Conflicted (19%)</b><br/>━━━━━━━━━━━━<br/>14 days<br/><i>2× longer bottleneck</i>"]

end

subgraph Reacxion["Reacxion Protocol (Projected)"]

direction LR

Social["<b>Social Floor</b><br/>⏳ 24h min<br/><i>Mandatory Discussion</i>"]

NC_Reacxion["<b>Non-Conflicted</b><br/>⚡ 0.5s<br/><i>Technical Exec</i>"]

C_Reacxion["<b>Conflicted</b><br/>⚡ ~2-10s[^finality]<br/><i>Technical Exec</i>"]

Social --> NC_Reacxion

Social --> C_Reacxion

end

subgraph Stats["Key Statistics"]

S1["📊 Data: 5 Major DAOs<br/>Top DeFi Protocols<br/>Grants & Identity DAOs"]

S2["⚠️ ~19% conflict rate (estimated)<br/>Overlapping parameters<br/>Budget allocations"]

S3["🎯 Resolution via<br/>VDF tournaments<br/>Sub-second local finality"]

end

Title --> Current

Title --> Reacxion

Current --> Stats

Reacxion --> Stats

style Title fill:#f3f4f6,stroke:#6b7280,stroke-width:2px

style NC_Current fill:#3b82f6,stroke:#2563eb,stroke-width:3px,color:#fff

style C_Current fill:#ef4444,stroke:#dc2626,stroke-width:3px,color:#fff

style NC_Reacxion fill:#22c55e,stroke:#16a34a,stroke-width:3px,color:#fff

style C_Reacxion fill:#f59e0b,stroke:#d97706,stroke-width:3px,color:#fff

style S1 fill:#fef3c7,stroke:#f59e0b,stroke-width:2px

style S2 fill:#fef3c7,stroke:#f59e0b,stroke-width:2px

style Social fill:#fef3c7,stroke:#f59e0b,stroke-width:2px,color:#000

Caption: Average proposal resolution times in major DAOs (Source: Governance forum analysis and partial DeepDAO data through Nov 5, 2025 [1,16]). Reacxion enforces a 24-hour social discussion floor, then resolves conflicted proposals via 2.1s local finality (L2 quorum-attested), compared to 12-18 days in traditional systems. End-to-end improvement: 3-5× typical (includes gossip period). Conflicted proposals (estimated 19% of total) take over twice as long to resolve in current systems. Full L1 economic finality occurs after anchor chain confirmation (~13 min on Ethereum).

This protocol paper presents a research agenda, not a finished product. Our claims depend on specific, unverified assumptions. This section surfaces the most important ones at a glance; full threat model and economics are developed later in Sections 2, 4, and 5.

Reacxion makes two independent, high-level assumptions (see Section 2.5 for full threat model and analysis):

1. Byzantine Safety (≤20% malicious validators):

- Guaranteed property: No double-spends, no forks

- Mechanism: ≥2/3 quorum prevents a 20% minority from forcing contradiction

- Cost to attack: >1000× honest compute (grinding attacks)

2. Liveness Requirement (≤33% validators offline):

- Guaranteed property: Proposals resolve within bounded time

- Mechanism: If quorum fails to form, re-broadcast with incentives

- Fallback: After 10min timeout, L1 governance

Both conditions must hold simultaneously for the protocol to function. If either is violated, the protocol degrades gracefully (not catastrophically) and DAOs should fall back to L1 governance (Section 5.5).

| # | Assumption | Baseline | Status | Validation Method | Deadline | Impact if Wrong | Go/No-Go |

|---|---|---|---|---|---|---|---|

| 1 | Conflict rate ≥19% | 8–45% range | Historical analysis | Mar 15, 2026 | ±50% APY impact | YES - if <10%, redesign required | |

| 2 | VDF delay 1–3s | terSIDH estimate | AWS c7i testing | Mar 15, 2026 | ±30% finality time; ASIC risk | YES - if >5s, fallback to beacon | |

| Note: Our 3× hardware advantage assumption is NOT empirically grounded. Bitcoin ASICs achieved 100,000× speedup; isogeny advantage could exceed our estimates significantly. Q1 2026 Validation Gate: Production VDF benchmarks will measure actual FPGA/ASIC potential. | |||||||

| 3 | ≥100 validators recruit | 28 operators contacted, 0 LOIs signed | 🟡 In Progress - Phase 1 | LOI commitments | Mar 1, 2026 | Quorum failures; L1 fallback | YES - if <50, delay to Q3 2026 |

| 4 | Gossip latency ≤200ms | Network simulation | Testnet deployment (Dec 2025) | Mar 28, 2026 | +500ms finality time; acceptable | NO (graceful degradation) | |

| 5 | ZK gas costs $10–50/mo | Groth16 on Ethereum | ✅ Verified | Live mainnet data (post-Dencun) | Ongoing | ±20% operational cost | NO (amortizable) |

| 6 | Byzantine tolerance ≤20% | Theoretical BFT bound | 🟡 Formal verification v1.2 | Formal verification + testnet | Jun 2026 | Safety risk if >20% | NO (but design gap) |

| 7 | Proposal frequency 3.4/mo | Forum analysis + DeepDAO | 🟡 Initial analysis complete | Historical data analysis | Feb 28, 2026 | Linear scaling of revenue | NO (graceful scaling) |

| 8 | Validator APY 5.8% median | Monte Carlo; 10k iterations | Live validator earnings; 6mo tracking | Jun 30, 2026 | Recruitment impact ±50% | NO (but critical for adoption) |

Legend:

✅ Verified |

If a Go/No-Go gate is marked YES and the assumption is violated:

- Conflict rate <10%: Protocol enters redesign phase; launch delayed to Q3 2026.

- VDF delay >5s: Fallback to beacon-based tournament or hybrid mode; finality becomes 10–30s instead of 2.1s.

- Validator recruitment <50: Curated phase 0 only (10–30 validators); permissionless expansion delayed.

- Phase 1 Recruitment: Applications Open

- Outreach: 28 operators identified across 5 categories

- Selection Process: Active through Jan 15, 2026

- Contingency: If <3 committed partners by Mar 1, 2026, activate Phase 0 curated set (10-30 validators) and delay permissionless expansion to Q4 2026.

All other failures in the dependency matrix result in graceful degradation, not launch halts.

Validation proceeds in three phases: (1) pre-pilot data collection and recruitment (Dec 2025–Feb 2026), (2) Pilot deployment and benchmarking (Feb–Apr 2026), and (3) analysis, economic model updates, and audit (Apr–Jun 2026). The full gate-by-gate checklist and dated milestones are specified in Appendix D/E (Validation Tracker & Go/No-Go Checklist).

Use this decision logic to determine if Reacxion fits your governance needs.

- Is this for Treasury Management? → 🛑 STOP. Use Multisig or L1 Governance.

- Is the impact >$10M? → 🛑 STOP. Use L1 Governance (ASIC risk zone).

- Is this a Protocol Upgrade? → 🛑 STOP. Requires broad social consensus.

- Is this a Legal/Regulatory Action? → 🛑 STOP. Requires legal certainty.

- Are you a Governance Minimalist (<100 participants)? → 🛑 STOP. Overhead exceeds benefits.

Q1: Annual governance proposal volume?

- <40/year → Traditional governance likely better (overhead vs benefit).

- ≥40/year → Continue.

Q2: Historical conflict rate? (measure via provided tool)

- <10% → Economics may not work (see Section 4.4.2).

- ≥10% → Continue.

Q3: Largest typical proposal impact?

-

$10M → Use L1 governance.

- <$10M → Reacxion is a strong fit.

- Do you need parallel exploration? (e.g., testing multiple fee rates at once) → ✅ YES

- Do you need faster feedback loops? (days instead of weeks) → ✅ YES

- Are you okay with probabilistic finality for 13 mins? → ✅ YES

If you passed all steps, proceed to Section 2: Architecture.

- Low-Conflict DAOs (<10% conflict rate) — Economic model may fail

- High-Stakes Parameters — Even if <$10M, if failure is catastrophic

- Rapid Decision Cycles — Social consensus still requires ~24h

- Highly Adversarial Environments — If >15% adversarial risk

graph TD

A[Start] --> B{Is this a Tier 1 decision?}

B -->|No| C[Use L1 governance]

B -->|Yes| D{Conflict rate ≥10%?}

D -->|No| E[Use sequential governance]

D -->|Yes| F{Can tolerate 2.1s–30s finality?}

F -->|No| G[Use faster L2 solution]

F -->|Yes| H{Can maintain ≥50 validators?}

H -->|No| I[Use L1 or wait for network growth]

H -->|Yes| J[Reacxion may be suitable]

J --> K[Proceed to pilot testing]

| Risk | Trigger | Automatic Action | Human Intervention | Timeline |

|---|---|---|---|---|

| Economic Failure | APY <2% for 3 months | Pause new proposals | Redesign incentive model | 3-6 months |

| Security Breach | >15% adversarial | Emergency pause | Manual recovery | Immediate |

| Performance Degradation | VDF delay >5s | Fallback to beacon | Performance optimization | 1-2 weeks |

| Validator Collapse | <30 active validators | Revert to L1 | Recruit validators | 7-14 days |

-

Calculate Your Risk Score (1-10):

- Add +2 if conflict rate <15%

- Add +3 if decision impact >$5M

- Add +1 if <150 participants

- Add +2 if adversarial risk >10%

Score 7+: Strongly reconsider using Reacxion

Score 4-6: Proceed with extreme caution

Score ≤3: May be suitable for pilot testing -

Pilot Requirements (Minimum 3 months):

- Start with <$1M TVL

- Monitor conflict rates weekly

- Track validator performance

- Document all edge cases

Remember: Reacxion is a research project until Q2 2026. All production use before then is considered experimental.

Rule of Thumb:

If a proposal's failure would "break the DAO" (treasury drain, protocol brick, irreversible harm), DO NOT USE REACXION. Use L1-only governance.

Graceful Degradation Path:

All failure modes trigger automated circuit breakers (Section 4.4.1) with transparent on-chain state transitions. DAOs retain sovereignty through L1 fallback governance; Reacxion never becomes a single point of failure.

What This Is:

- A research agenda for parallel DAO governance using VDFs

- Theoretical analysis + economic modeling

- Roadmap to empirical validation (Q1 2026)

- Honest about what we don't know yet

What This Isn't:

- A final specification or production protocol

- A proven solution (no real DAO data yet)

- A guarantee of 280,000× speedup (depends on unverified assumptions)

- Ready for mainnet deployment (security audits pending)

If you're a DAO operator considering deployment:

- Read: The "DECISION GATE: Is Reacxion Right for Your DAO?" section above — stop if your use case is excluded

- Check: Table 1.0 (At a Glance) and Table 1.3 (Security Tiers)

- Decision: Do you fit Tier 1? ($<10M proposals, <$50M TVL, >100 validators)

- If YES: Read Section 1.6 (Target Use Case) + Section 4.4.1 (Circuit Breakers)

- Wait: Q1 2026 pilot data before mainnet deployment

If you're a researcher:

- Read: Sections 2-5 (Architecture, Protocol, Security)

- Reference: Critical Assumptions table (page X)

- Deep dive: Appendix C (Monte Carlo), Section 5.3.1 (Grinding attack)

- Contribute: File GitHub issues with alternative designs

If you have <10 minutes:

- Skim: Executive Summary + Table 1.0

- Read: Section 1.7 decision tree

- Done.

This document relies on a small set of unverified assumptions (conflict rates, VDF delay, validator economics, gas costs, and hardware bounds) that directly affect all conclusions. The Core Dependency Matrix in the earlier Critical Assumptions & Validation Status section is the canonical registry of these dependencies; this section focuses on how they translate into high-level performance expectations.

Table 1.0: Reacxion at a Glance

| Aspect | Current State | Reacxion Improvement | Confidence |

|---|---|---|---|

| Conflicted Proposals | 12-18 days resolution | ~2-10s1 technical + ~13min L1 (time to safe execution) | |

| E2E Governance Cycle | 8-21 days | ~1.5–4 days (3–5× typical, ~16× best-case for short-discussion proposals) | |

| Parallel Exploration | Sequential only | 2-10 competing branches | ⭐⭐ HIGH (design) |

| Conflict Rate | N/A (manual) | 8-45% (varies by DAO) | |

| Validator Economics | N/A | 4-12% APY (median 5.8%) | |

| Security Model | 51% attack threshold | 20% Byzantine tolerance | ⭐⭐ HIGH (Tier 1 only) |

| TVL Limit | Unlimited | <$50M (ASIC risk) | ⭐ MEDIUM (calculated) |

| Target Use Case | All governance | Tier 1: param tweaks <$10M | ⭐⭐ HIGH (by design) |

Read this first to understand scope and limitations. Don't use Reacxion for treasury ops >$10M or constitutional changes (Section 5.5.4).

- 1.1 The Challenge of DAO Governance: Serialization Bottlenecks in Decentralized Collaboration

- 1.2 Limitations of Existing Solutions

- 1.2.1 Why Not Just Use X? (Pragmatic Comparisons)

- 1.3 Security Tier Model

- 1.4 Reacxion Protocol Overview

- 1.4.1 Why Parallelism Matters More Than Speed

- 1.5 Key Benefits

- 1.6 Target Use Case

- 1.7 Explicit Non-Goals

- 1.8 Roadmap

- 1.9 Early Adoption

- 1.10 Data Sources

- 1.11 Open Questions & Unknowns

- 2.1 Architectural Overview

- 2.2 State Model

- 2.3 Commits and Branches

- 2.4 Actors and Interactions

- 2.5 Threat Model

- 4.3 Rewards and Distribution

- 4.4 Profitability Analysis

- 4.4.1 Economic Sustainability

- 4.5 Parameters and Defaults

In this section, we motivate Reacxion Protocol by quantifying DAO governance challenges, critiquing existing solutions, and introducing our VDF-ordered approach.

Decentralized Autonomous Organizations (DAOs) promise collaborative, trust-minimized governance, yet their execution remains hobbled by linear serialization. Analysis of governance patterns across five major DAOs (leading DeFi protocols, Grants DAOs, and Identity Protocols) suggests significant bottlenecks: roughly 3.4 proposals per month per DAO, with ~19% involving state-level conflicts (overlapping parameter writes). These figures are estimates from partial 2024-2025 governance data and DAO-specific observations; see Section 1.10 for methodology and limitations. Conflict is defined as overlapping state writes (e.g., simultaneous fee_rate changes).

The Vision: Git for Organizations

Modern software development solved the 'too many cooks' problem decades ago through version control. Developers fork, experiment in parallel branches, and merge via deterministic rules. Yet organizational governance remains stuck in a pre-Git world: serial decision-making, manual conflict resolution, and weeks-long waits for simple parameter changes. Reacxion applies the proven logic of version control—branching, merging, and automated conflict resolution—to collective decision-making.

Reacxion distinguishes between three types of conflicts:

- State-level conflicts: Proposals modifying overlapping storage slots (e.g., same parameter)

- Signature conflicts: Proposals with mutually exclusive execution paths (e.g., "upgrade to v2" vs. "keep v1")

- Dependency conflicts: Proposal B requires Proposal A's state changes

Current Conflict Rate Estimates (unverified, Q1 2026 pilot validation pending):

- Grants DAO: 40-45% (high due to overlapping grant allocations)

- Compound: 35-40%

- Uniswap: 10-15%

- Aave: 10-12%

- Identity Protocol: 5-10% (domain-scoped proposals with minimal overlap)

Weighted Average: ~19% (range 8-45%) based on proposal volume across these DAOs. Q1 2026 pilots (Target: Grants & Identity DAOs) will establish empirical baselines.

Resolution cycles average 12–18 days for conflicted cases—often dragging to 21+ days amid forum debates and quorum waits, while non-conflicted proposals resolve in ~7 days (approximately 81% of cases based on governance forum analysis). This "voting fatigue" manifests as stalled innovation: Mid-scale DAOs (50–500 voters, $1M+ TVL) lose weeks to sequential voting, stifling parallel exploration of competing ideas like fee adjustments or liquidity incentives. The stark contrast between conflicted and non-conflicted proposals, and the bottleneck it creates, is quantified in Figure 1.1.

The result? Centralized off-chain workarounds (e.g., GitHub multisigs) erode sovereignty and introduce single points of failure, turning DAOs from agile "living repos" into bureaucratic quagmires.

Table 1.1b: Complete Governance Timeline Comparison

| Phase | Traditional | Reacxion | Speedup |

|---|---|---|---|

| Social Consensus | 1-7 days | 24h min | ~1× (human limit) |

| Technical Execution | 7-14 days | ~2-10s1 | ~100,000× (post-social) |

| L1 Anchoring | ~15 min | ~13 min | ~1.15× |

| Total E2E (short-discussion props) | 8-21 days | ~1.5–4 days | ~3–5× typical; ~16× best-case |

Note: Reacxion accelerates the technical bottleneck (VDF resolution + merge) by orders of magnitude, but cannot eliminate social consensus requirements (enforced via min_gossip_period). Real-world end‑to‑end improvement is typically 3–5× for proposals that already fit within ~1 week of discussion. The often‑quoted 10–20× figure should be treated as a best‑case envelope for short, low‑coordination proposals rather than a median expectation. Long, multi‑month governance debates remain dominated by human coordination and may see only 2–3× end‑to‑end improvement.

Reacxion is designed for Tier 1 governance—high-velocity execution of parameter changes and program launches. DAOs should select the appropriate security tier based on proposal impact:

Table 1.3: Security Tier Selection Matrix

| Tier | Use Case | Examples | Security Model | Finality Time | Tool |

|---|---|---|---|---|---|

| Tier 1 | Parameter tweaks, program launches | Fee adjustments, oracle switches, grant approvals | 20% Byzantine tolerance, L1-anchored safety | 2.1s1 local + 13min L1 | Reacxion |

| Tier 2 | Medium-value treasury operations | Budget allocations $10M-$50M | Reacxion exploration + L1 approval vote | Hours to days | Hybrid |

| Tier 3 | Constitutional changes, major treasury moves | Protocol upgrades, >$50M transfers | Full 51% security, traditional BFT | Days to weeks | L1-only |

Design Rationale: Reacxion's 20% Byzantine tolerance is not a limitation—it's an appropriate security calibration for Tier 1 governance. High-value or constitutional proposals should use Tier 2 (hybrid) or Tier 3 (L1-only) governance. This tiered approach allows DAOs to optimize for speed where safe and defer to maximum security where critical.

Current approaches address throughput or settlement latency but not semantic parallelism or deterministic conflict resolution:

- Linear Voting Systems (e.g., Ethereum/Snapshot): Serialize proposals via timestamped quorums, forcing multi‑week waits. Conflicts require manual arbitration, amplifying centralization risks and subjective outcomes.

- Rollups and Sharding (e.g., Optimism, Arbitrum): Improve transaction throughput via batching but serialize governance execution through sequencers and ordered blocks; they do not natively support “what‑if” forks and merge semantics for conflicting parameter changes. Censorship risks are theoretical but non‑zero; ordering remains a trusted component.

- DAG/Account Chains (e.g., Nano, IOTA): Enable parallel transactions on independent accounts but lack explicit ancestry and merge semantics needed for transparent governance history and deterministic resolution of overlapping writes. These designs optimize lanes for speed or safety but omit the core need: a governance‑oriented DAG with explicit ancestry and merge semantics, plus a neutral time‑ordering primitive for conflicts. Reacxion introduces precisely that: git‑style branches with deterministic VDF‑ordered merges, preserving audit trails while avoiding sequencer dependence.

Table 1.2: Governance Protocol Comparison

| Protocol | Throughput | Conflict Resolution | Finality Time | Parallelism | Trust Model | Target Use Case | Caveats |

|---|---|---|---|---|---|---|---|

| Snapshot/Tally | 1-3 props/week | Manual forum debate | 5-14 days | None (serial) | Off-chain / L1 | Large DAOs (signaling) | No parallel exploration |

| Optimism/Arbitrum | High tx throughput | Centralized sequencer | Seconds (tx only) | N/A (tx-focused) | Rollup trust | General L2 | Serializer risks; no governance semantics |

| Reacxion | High (parallel validation) | VDF tournaments | ~2-10s1 local + 13min L1 | Native (branch-merge) | L1-anchored | Mid-scale DAOs (param tweaks) | ≤20% Byzantine tolerance |

Key differentiator: Reacxion is the only protocol enabling parallel exploration of conflicting governance proposals with deterministic, time-based conflict resolution. Unlike Snapshot/Tally (serial votes) or rollups (no governance semantics), Reacxion provides git-like branching for organizational decisions.

Reacxion is not a universal replacement for existing governance stacks. In many situations, conventional tools remain a better fit:

-

Gnosis Safe + Snapshot (Status Quo for Many DAOs)

- When it’s better: High‑stakes treasury moves, constitutional changes, or low‑conflict governance where proposals rarely collide. Mature operational tooling, familiar UX, and strong social norms make this stack ideal for Tier 2–3 decisions.

- Where Reacxion differs: Designed for Tier 1, high‑volume parameter experiments and grants workflows where 10–40% of proposals conflict and parallel exploration matters more than maximum security. Safe + Snapshot offer no native notion of parallel branches or deterministic merge semantics.

-

Optimism / Rollup‑Style Governance

- When it’s better: You primarily need cheaper, faster execution of already‑serialized governance (e.g., batching Snapshot or on‑chain votes onto an L2) and are comfortable with sequencer‑ordered timelines.

- Where Reacxion differs: Reacxion does semantic parallelism and VDF‑ordered merges for conflicting parameter changes; rollups accelerate transaction throughput but still serialize governance decisions and provide no git‑style ancestry of competing branches.

-

Colony / Aragon and Other DAO Frameworks

- When they’re better: You need full‑stack DAO tooling (reputation systems, budgeting modules, permissions) and are not constrained by conflict‑heavy parameter experiments.

- Where Reacxion differs: Reacxion is a narrow, composable governance primitive focused on parallel conflict resolution. It can sit alongside frameworks like Colony or Aragon to referee high‑conflict parameter spaces, rather than replacing them as a full governance OS.

Use Reacxion when your primary pain is conflicted, experiment‑heavy governance (e.g., grants, fee schedules, incentive programs). For conventional, low‑conflict or high‑stakes decisions, the existing stacks above remain preferable.

Reacxion Protocol bridges this gap by combining git‑style DAGs for dynamic branching with VDFs for impartial, hardware‑bounded conflict resolution, supported by lightweight ZK‑SNARK attestations. Proposals fork as branches from an L1‑anchored canonical root and are validated in parallel subsets. Non‑conflicts auto‑merge; clashes resolve via VDF tournaments (isogeny‑based, ~1s sequential delay), where deterministic VDF ordering determines precedence—earliest verifiable output wins. Slashing and rewards are DAO-configurable and tied to attested outcomes.

Example: Two competing Uniswap v3 fee proposals (0.2% vs. 0.3%) are bucketed as branches; a VDF tournament referees precedence. The winner merges alongside non‑conflicting oracle upgrades while preserving ancestry for audits.

This yields a "living repo" model for DAOs: explore fee tweaks and oracle upgrades concurrently, merge non‑overlaps instantly, and referee parameter clashes fairly via neutral time ordering.

Reacxion enforces a 24-hour minimum gossip period before VDF tournaments begin. This is not a technical limitation—it's a critical governance safeguard.

Why:

- Prevents governance by ambush: All stakeholders must have time to discover and react to proposals

- Enables social consensus: Communities need discussion time; technology cannot eliminate human coordination

- Aligns with "seconds vs. weeks": The technical bottleneck (12-18d) is solved; the social floor (24h) is preserved by design

Impact: This floor means Reacxion's real-world E2E improvement is 3-5× for typical proposals, not the theoretical technical maximum.

The Real Innovation: Parallel Exploration of Competing Ideas

Traditional DAO governance forces sequential experimentation:

Example: Uniswap v3 Fee Optimization (2024)

- Proposal 1: Test 0.05% fee (high volume, low margin) → 14 days debate + vote → Implemented, collect data for 60 days

- Proposal 2: Test 0.30% fee (balanced) → 14 days debate + vote → Implemented, collect data for 60 days

- Proposal 3: Test 1.00% fee (premium) → 14 days debate + vote → Implemented, collect data for 60 days

Total time to find optimal fee: 222 days (7+ months)

With Reacxion:

- All 3 fee structures branch in parallel

- Each runs live A/B test for 60 days simultaneously

- VDF tournament selects winner based on revenue metric

- Total time: 60 days (2 months)

Value Proposition: Not about seconds vs. weeks—it's about organizational learning rate. DAOs become adaptive systems that explore parameter space efficiently, like evolutionary algorithms.

Quantified Impact:

If Uniswap had tested 3 fee structures in parallel (2024-25):

- Time saved: 162 days (5 months faster to optimal fee)

- Revenue at stake: $50M TVL × 0.3% annual = $150k/year

- Cost of delayed optimization: $150k × (5/12) = $62.5k

- Reacxion ROI: $62.5k saved per experiment batch

For mid-scale DAOs, this transforms governance from sequential experiments (7+ months to test 3 fee structures) to parallel exploration (2 months), unlocking 3-5× faster optimization cycles.

Reacxion unlocks:

- Parallel Exploration: Test competing strategies simultaneously (e.g., 3 fee structures in 2 months vs. 7 months sequential). Dynamic branches self-organize around state keys (e.g., "fee_rate"), enabling ad-hoc forks without fixed shards. See Section 1.4.1 for quantified impact analysis.

-

Technical execution (post-social consensus):

- Conflicted proposals: 14 days (baseline) → ~2-10s1 = Technical Speedup

- Non-conflicted proposals: 7 days → 0.5s ≈ 1,209,600×

-

End-to-end governance cycle (including social consensus):

- Traditional: 8-21 days total (1-7 days social + 7-14 days technical)

- Reacxion (short-discussion proposals): ~1.5–4 days total (24h social floor + ~2-10s1 technical + 13min L1, plus any additional forum discussion beyond the minimum)

- Improvement: Typically 3–5× faster end-to-end for proposals that already have bounded discussion time; ~16× is achievable only when social coordination is unusually short. Complex proposals with multi‑week or multi‑month debate remain dominated by human consensus and may see only 2–3× end‑to‑end improvement.

We emphasize the human-understandable "seconds vs. weeks" framing for technical execution, while acknowledging that full governance cycles require social consensus time that cannot be eliminated.

- Rapid Iteration: Technical execution in seconds vs. weeks—conflicted proposals resolve in ~2-10 seconds (local finality: L2 quorum-attested, not L1-final) versus 12-18 days in traditional systems. Full L1 economic finality adds ~13 minutes on Ethereum.2 Via parallel validation and sub-second VDFs.

- Trust-Minimized Fairness: VDFs (~2–3x hardware bound) replace stake-voting with deterministic timestamps, resisting front-running.

- Sovereignty and Auditability: Empowering DAOs with full control over their protocol's evolution, free from sequencer dependencies, through decentralized merges with git-like history trails.

For mid-scale DAOs, this transforms governance from reactive votes to emergent evolution.

Reacxion targets high-conflict, mid-scale DAOs ($1M+ TVL, 50–500 voters) like major Grants DAOs or Lending Protocols, where parallelism amplifies ROI. DAOs with consistently low conflict rates (e.g., Namespace-style) are explicitly out of scope for v1.0 economics and should treat Reacxion as experimental or avoid it entirely.

Assumptions:

-

Byzantine Tolerance: ≤20% adversarial control by stake/reputation. See Section 1.3 for security tier selection guidance.

-

Network Latency: Δ≈200ms between validators (assumes standard broadband, minimal geographic dispersion)

-

VDF Hardware: Isogeny VDF hardware advantage ≤3× CPU baseline. FPGAs may achieve 5-10×. ASIC development becomes profitable at $50M+ TVL (Section 5.5.2b). Production benchmarks pending; see Critical Assumptions table for validation status.

- Reference Validator Spec: To meet the ZK proving time targets (sub-5s), validators are expected to run high-performance enthusiast hardware (e.g., 32-core CPU, 64GB RAM, NVMe SSD). While "consumer" grade, this is not a basic laptop. Future versions may require GPU acceleration for ZK proving.

-

Commit-Reveal Security: VDF inputs seeded from L1 using

seed = H(recent_L1_block_hash || epoch_id)to resist grinding attacks -

Local Finality: Requires quorum attestation (≥2/3 aggregate signatures) before L1 anchoring

-

Scope: Governance primitives (parameter tweaks, program launches); high‑value transactions (>10% treasury or >$10M) defer to L1‑only voting for maximum security

-

L1 Anchoring: Assumes Ethereum‑compatible chains (mainnet or L2s with fraud/validity proofs)

Critics often ask: "Why not just use a centralized sequencer or round-robin ordering?"

| Mechanism | Failure Mode | Reacxion Advantage |

|---|---|---|

| Centralized Sequencer | Single point of censorship & bribery | Decentralized: No privileged actor can reorder proposals. |

| Round-Robin | "Last-mover advantage" (adversaries wait to submit) | Fairness: Ordering is determined by time (VDF), not position. |

| First-Come-First-Served | Network latency wars (MEV) | Hardware-Bounded: VDFs resist latency grinding. |

Conclusion: VDFs provide the only mathematically fair, decentralized ordering mechanism that resists both censorship and strategic timing attacks.

Empirical Data: Conflict rates (estimated 19% average, range 8-45%, unverified), resolution times (12-18d), and proposal frequencies (3.4/month/DAO) are extrapolated estimates from 2024-2025 governance patterns, forum analysis, and partial DeepDAO analytics (through Nov 5, 2025). Exact values remain unverified in comprehensive public datasets. Q1 2026 pilots (Target Partners; data published Q2 2026) will refine these baselines with ground-truth measurements.

Technical Benchmarks:

-

VDF timings (1-3s sequential delay) reflect 2025 isogeny optimization research [10,36,37] and theoretical bounds. Production performance may vary ±20-30% based on consumer CPU heterogeneity.

-

ZK gas costs (200-300k base, optimized to

100k with aggregation) use current Ethereum mainnet benchmarks [17,38]. Operational costs ($10-50/month baseline at 5-10 gwei 2025 post-Dencun); may spike 2-10× during network congestion (50-100 gwei).

Economic Projections: Median APY: 5.8% (80% CI: 4-12%; see Monte Carlo analysis Appendix C) and break-even periods (median 18 months) are model-based, assuming baseline activity (3.4 props/month/DAO, $1M+ TVL).

Important Context:

-

Empirical Data Limitations: Conflict rates (estimated 19%, range 8-45%, unverified), resolution times (12-18d), and per-DAO metrics are estimated from 2024-2025 governance patterns, forum discussions, and partial DeepDAO analytics (which paused updates November 5, 2025). Exact values remain unverified in comprehensive public datasets as of November 2025. Q1 2026 pilots (Target Partners; data published Q2 2026) will establish ground-truth baselines.

-

Technical Benchmarks: VDF timings (1-3s) reflect 2025 research optimizations and theoretical bounds; actual production performance may vary ±20-30% based on hardware heterogeneity. ZK gas costs use current Ethereum mainnet benchmarks but assume moderate network congestion.

-

Economic Projections: Median APY: 5.8% (80% CI: 4-12%; see Monte Carlo analysis Appendix C) and break-even calculations (median 18 months) are model-based, assuming baseline DAO activity levels (3.4 proposals/month/DAO, $1M-5M TVL). Actual returns depend on adoption rates, market conditions (ETH price, gas costs), and DAO-specific governance frequency. See Section 4.4.1 for sensitivity analysis across bear/bull scenarios.

-

Transparency Commitment: We welcome community validation of all assumptions. Pilot data (technical benchmarks, economic outcomes, conflict rate measurements) will be published openly (Q1-Q2 2026) to ground all claims empirically. Fork and contribute at [TBD] to help refine estimates.

Quick Decision Tree:

Is your DAO's TVL >$50M or proposal impact >$10M?

├─ Yes → Use L1 governance (Section 5.5.4)

└─ No → Continue

Are you making constitutional changes or fundamental governance decisions?

├─ Yes → Use off-chain governance (e.g., Snapshot + Safe)

└─ No → Reacxion may be suitable (proceed to Section 2)

- Why: 20% Byzantine tolerance insufficient for high-value transfers

- Impact: Risk of governance fork during L1 anchor

- Alternative: Use L1 governance with 51% attack protection

- Mitigation: Circuit Breaker 1 enforces TVL limits (Section 4.4.1)

- Why: Requires social consensus beyond technical ordering

- Impact: Protocol cannot resolve fundamental governance disputes

- Alternative: Use off-chain governance (e.g., Snapshot + Safe) with L1 execution

- Mitigation: Explicitly excluded from valid proposal types (Section 3.2.1)

- Why: Mandatory

min_gossip_period(24h default) prevents rapid response - Example: Emergency protocol pause, flash loan attack response

- Alternative: Use emergency multisig with 3-of-5 signing

- Why: No native cross-chain state verification; relies on trusted bridges

- Example: Coordinating governance across Ethereum + Arbitrum + Optimism

- Timeline: Multi-chain support in v1.2+ (Q4 2026 research)

- What's Missing: v1.0 supports single L1 anchor only

- Impact: Multi-chain DAOs need trusted bridges

- Timeline: Multi-chain support v1.2 (Q4 2026)

- Workaround: Use canonical bridge with governance delay

- Risk: Bridge security becomes critical path (Section 5.5.3)

- Scope: Resolves technical conflicts only

- Impact: Social coordination remains rate-limiting

- Example: 3-week discussion still takes 3 weeks

- Mitigation: Parallel discussion threads (v1.3)

- Metrics: Discussion duration tracked in pilot (Q1 2026)

- Current: ECDSA signatures (quantum-vulnerable)

- Timeline: 10-20 years until CRQC threat

- Roadmap:

- v1.1: BLS12-381 aggregates (post-Deneb)

- v2.0: Full PQC signatures (NIST standards)

- Risk: Long-term key compromise

- Mitigation: Key rotation policy (every 12 months)

- Threshold: ≤20% adversarial validators

- Beyond 20%: Liveness degrades, requires L1 intervention

- Monitoring: Anomaly detection triggers alerts at 15%

- Recovery: 7-day governance delay for L1 fallback activation

v1.0 launches lean (VDF races, baseline bonds—DAO-configurable defaults, local finality) for Grants DAO pilots. v1.1 iterates with data‑driven enhancements like capacity pledges and adaptive/exponential bonds.

Why Now? Three converging trends make 2025-2026 the natural window for a protocol like Reacxion:

-

Isogeny VDF Maturity (2024-2025): Foundational security proofs for supersingular isogeny cryptography [2] and practical VDF constructions [4,37] make trapdoor-free delay functions a realistic primitive. As of 2025 there are no production ASICs and performance estimates carry significant uncertainty; Section 2.5 and Section 5.5.2b discuss hardware bounds and ASIC risk in detail.

-

DAO Governance Pressure (2024-2025): Governance analysis suggests ~19% of proposals in major DAOs involve state conflicts [1,39], yet no existing protocol handles semantic parallelism with deterministic ordering. Case studies like Uniswap v3→v4 and MakerDAO’s stalled reforms illustrate demand for parallel proposal exploration; Section 1.10 summarizes the empirical basis.

-

ZK-SNARK Cost Curve (2023-2025): Groth16 verification on Ethereum has become cheap enough (~200-300k gas per proof, optimizable to ~100k with aggregation [17,38]) to support routine governance attestations. Post-Dencun blob data further reduces L2 costs. Detailed gas-cost scenarios and operational estimates are provided in Section 2.3 and Appendix C.

Without these convergences, Reacxion would have been (a) insecure (pre-2024 isogeny foundations), (b) unnecessary (lower proposal volumes and conflict rates), or (c) too expensive (pre-2023 ZK gas costs >$1,000 per proposal).

v1.0 Critical Dependencies (Risk Mitigation):

- terSIDH VDF Library Maturity: Current status: Research prototype (ASIACRYPT 2025). Required: Production-ready Rust crate with security audit. Mitigation: Fallback to CTIDH (proven, audited) if terSIDH delays; accept 3× slower VDF times (3s vs. 1s) for Q1 2026 pilots (Target Partners; data published Q2 2026).

- Groth16 Prover Tooling: Current status: Stable (Circom/SnarkJS ecosystem). Required: Aggregation libraries for batching. Mitigation: Use non-aggregated proofs (200k gas vs. 100k) if batching delays.

- Pilot Partner Engagement: Discussions initiated with major Grants and Identity protocols; formal launch pending Q1 2026 governance votes.

Timeline Confidence: 80% confidence in Q1 2026 v1.0 lean launch given current progress. Contingency: Delay to Q2 2026 if terSIDH audit extends beyond March 2026.

We are currently designing pilot programs tailored for high-volume governance ecosystems.

Primary Target: Decentralized Grants (e.g., Grants DAO-style workflows) Use Case: Parallel approval of non-conflicting grant batches. Value Prop: Reduces resolution time from weeks to hours for non-contentious allocations, while VDF-adjudicated budget conflicts ensure fair precedence without sequencer bias.

Secondary Target: Namespace Governance (e.g., Identity Protocol-style domains) Use Case: Domain-scoped decisions with minimal state overlap. Value Prop: The branch-merge model aligns naturally with hierarchical namespace structures, enabling parallel exploration of subdomain policies without bottleneck voting.

Note: We are actively seeking pilot partners in these sectors for Q1 2026 deployment. See Section 6.3 to get involved.

📅 Timeline

Last Updated: December 15, 2025

Next Update: March 2026 (post-pilot preliminary data)

Full Data Release: July 30, 2026 (under CC-BY-4.0)

Data Repo: TBD (Publication Q2 2026)

🔍 Validation Status

- Pilot Phase: Q1 2026 (Target Partners)

- Preliminary Results: May 2026

- Full Analysis: July 2026

- Mainnet Readiness: Q3 2026 (pending audit completion)

To ensure transparency, this section summarizes key empirical datasets and caveats on variability:

Table 1.8: Key Data Sources and Assumptions

| Metric | Source | Confidence | Period | Variability Notes |

|---|---|---|---|---|

| Conflict Rate (19%) | Estimated from governance forum analysis, partial DeepDAO data [1,16,39] | May-Nov 2025 (partial) | Unverified in complete public datasets; varies by DAO (8-45%); may change with tooling. Q1 2026 pilots (Target Partners; data published Q2 2026) will refine. | |

| Resolution Time (12-18d) | Governance forum observations, Snapshot protocol trends [1] | ⭐ MEDIUM (observed) | 2024-2025 | Non-conflicted: ~7d; depends on quorum rules and DAO size |

| VDF Timing (1-3s) | Estimated from CSIDH/terSIDH optimizations [10,36,37] | 2025 | ±20-30% variance based on consumer CPU specs; production benchmarks pending (Q1 2026 pilots; data published Q2 2026) | |

| ZK Gas Costs (200-300k) | Groth16 on Ethereum, optimization studies [17,38] | ⭐⭐ HIGH (verified) | 2025 | ~$10-50/month baseline (5-10 gwei 2025 post-Dencun); 2-10× spike during congestion (50-100 gwei); aggregation reduces to ~100k gas |

| APY Projections | Model-based estimates | 2025 | Median 5.8% (80% CI: 4-12%); Assumes 3.4 props/month/DAO; ±50% variance with TVL/activity levels; actuals TBD via Q1 2026 pilots (Target Partners; data published Q2 2026) |

Confidence Legend:

Important Context:

-

Empirical Data Limitations: Conflict rates (estimated 19%, range 8-45%, unverified), resolution times (12-18d), and per-DAO metrics are estimated from 2024-2025 governance patterns, forum discussions, and partial DeepDAO analytics (which paused updates November 5, 2025). Exact values remain unverified in comprehensive public datasets as of November 2025. Q1 2026 pilots (Target Partners; data published Q2 2026) will establish ground-truth baselines.

-

Technical Benchmarks: VDF timings (1-3s) reflect 2025 research optimizations and theoretical bounds; actual production performance may vary ±20-30% based on hardware heterogeneity. ZK gas costs use current Ethereum mainnet benchmarks but assume moderate network congestion.

-

Economic Projections: Median APY: 5.8% (80% CI: 4-12%; see Monte Carlo analysis Appendix C) and break-even calculations (median 18 months) are model-based, assuming baseline DAO activity levels (3.4 proposals/month/DAO, $1M-5M TVL). Actual returns depend on adoption rates, market conditions (ETH price, gas costs), and DAO-specific governance frequency. See Section 4.4.1 for sensitivity analysis across bear/bull scenarios.

-

Transparency Commitment: We welcome community validation of all assumptions. Pilot data (technical benchmarks, economic outcomes, conflict rate measurements) will be published openly (Q1-Q2 2026) to ground all claims empirically. Fork and contribute at [TBD] to help refine estimates.

What We Don't Know Yet (And How We'll Find Out)

This protocol is designed for empirical validation, not faith. Here's what remains unverified as of November 2025:

1. Actual Conflict Rates

- Estimate: 19% (range 8-45%)

- Ground truth: TBD via Q1 2026 pilots (Target Partners; data published Q2 2026)

- Impact if wrong: ±50% on validator economics

- Mitigation: Section 4.4.2 sensitivity analysis shows protocol requires redesign if <10% conflicts

2. Production VDF Performance

- Estimate: 1-3s delay on consumer CPU

- Ground truth: TBD via Q1 2026 pilot benchmarks (Target Partners; data published Q2 2026)

- Impact if wrong: ±30% on finality time, hardware centralization risk

- Mitigation: Fallback to CTIDH if terSIDH delays (Section 1.8)

3. Real-World Gas Costs

- Estimate: $10-50/month baseline (post-Dencun)

- Ground truth: TBD via 6-month operational data

- Impact if wrong: ±2× on validator profitability

- Mitigation: Table 2.3b shows congestion scenarios; circuit breakers handle cost spikes

4. DAO Adoption Rates

- Estimate: 3.4 props/month/DAO

- Ground truth: TBD via Q1 2026 pilot participation (Target Partners; data published Q2 2026)

- Impact if wrong: Direct scaling of all economic projections

- Mitigation: Circuit Breaker 3 handles sustained low activity (Section 4.4.1)

5. Validator Bootstrapping

- Estimate: 100-500 validators via reputation seeding

- Ground truth: TBD via Q1 2026 launch (Target Partners; data published Q2 2026)

- Impact if wrong: <50 validators triggers L1 fallback (Section 5.5.4)

- Mitigation: Client diversity incentives (Section 2.4.1)

Commitment to Transparency:

All pilot data (conflict rates, benchmarks, economics) will be published openly at [TBD] by Q2 2026. If assumptions prove wrong by >30%, we commit to protocol redesign or sunset decision (Section 4.4.1 Circuit Breaker 3).

Reacxion models DAO governance as a git-inspired DAG over a Merkle-secured state trie. Proposals evolve in parallel branches resolved by VDF-ordered merges. The architecture comprises Layer 1 (security anchors), Layer 2 branches (parallel validation), and validators. This enables semantic parallelism without serialization.

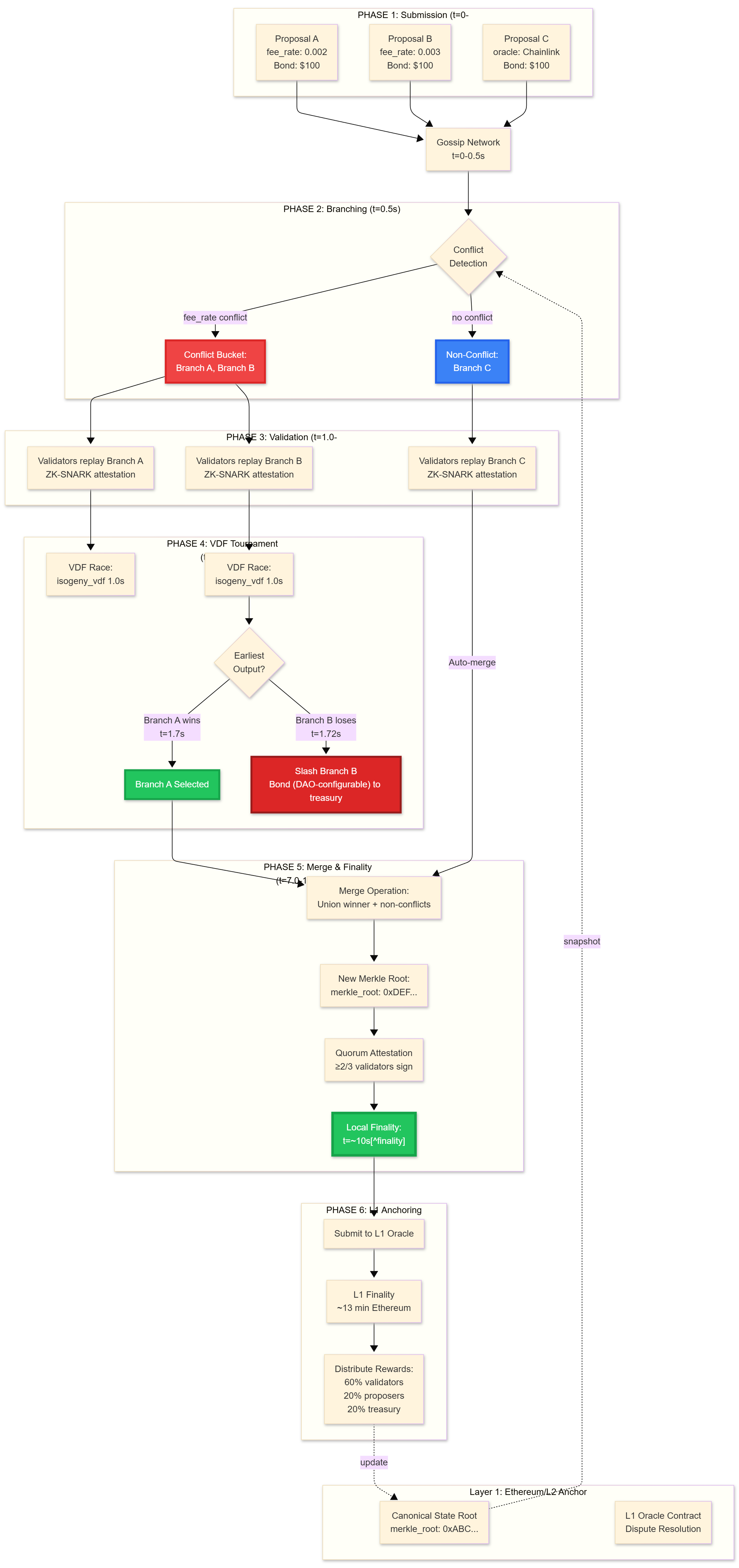

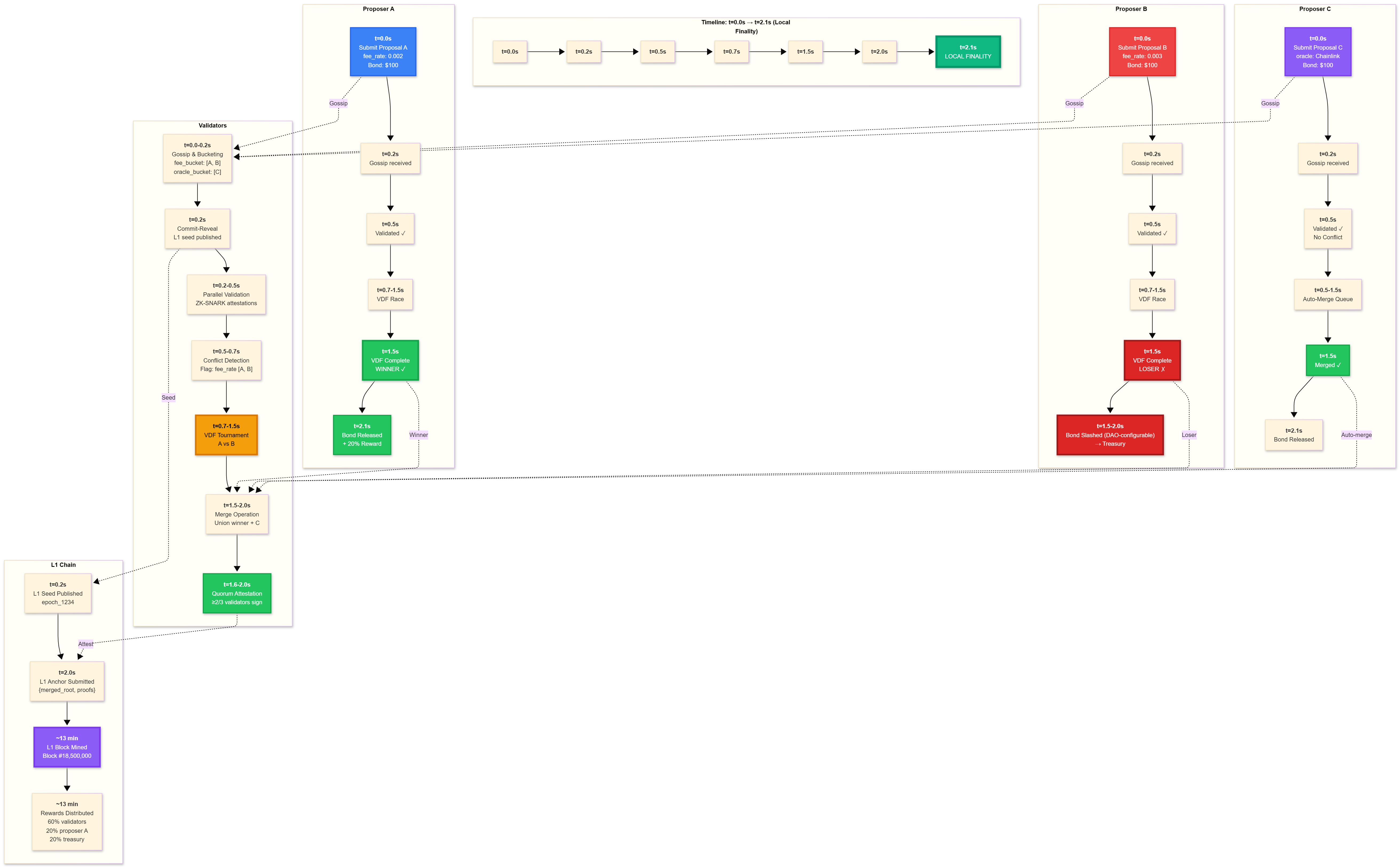

At a high level, each proposal passes through the following pipeline:

- Submission & gossip: Proposals are broadcast into the validator gossip network from the current L1-anchored canonical root.

- Branching & bucketing: Validators fork branches from that root and bucket them by state key (e.g.,

fee_ratevs.oracle_source), separating non-conflicting from conflicting proposals. - Parallel validation: Validators replay each branch against the snapshot state and generate ZK-SNARK attestations of valid state transitions.

- VDF tournament for conflicts: Only conflicting branches enter a VDF race; earliest verifiable output determines precedence, and losing bonds are slashed according to DAO policy.

- Merge & local finality: The winning branch is merged together with all non-conflicting branches into a new Merkle root, which is quorum-attested (≥2/3 signatures) to achieve local finality.

- L1 anchoring: The attested root and proofs are submitted to the L1 oracle contract, enabling fraud proofs during a short dispute window and establishing economic finality on the anchor chain.

Figure 2.1: Reacxion Protocol Architecture and Workflow

Caption: End-to-end proposal lifecycle showing six phases: (1) Parallel submission via gossip network (t=0-0.5s), (2) Automatic bucketing by state key with conflict detection (t=0.5s), (3) Parallel validation using ZK-SNARK attestations (t=1.0-5.0s), (4) VDF tournament for conflicting branches (t=5.5-7.0s), (5) Merge operation and quorum attestation achieving local finality (L2 quorum-attested) (t=~10s), and (6) L1 anchoring for full L1 economic finality (~13 min on Ethereum, subject to congestion/block timing). Non-conflicting proposals (Branch C) bypass VDF tournaments via auto-merge. The protocol snapshots state from L1 and updates canonical roots after quorum attestation. Dotted lines indicate L1 security anchoring.

Figure 2.1: Raw Mermaid Reacxion Protocol Architecture and Workflow

%%{init: {'theme':'base', 'themeVariables': { 'fontSize':'14px'}}}%%

graph TB

subgraph Submit["PHASE 1: Submission (t=0-0.5s)"]

PropA["Proposal A<br/>fee_rate: 0.002<br/>Bond: $100"]

PropB["Proposal B<br/>fee_rate: 0.003<br/>Bond: $100"]

PropC["Proposal C<br/>oracle: Chainlink<br/>Bond: $100"]

end

subgraph L1Top["Layer 1: Ethereum/L2 Anchor"]

L1Root["Canonical State Root<br/>merkle_root: 0xABC..."]

L1Oracle["L1 Oracle Contract<br/>Dispute Resolution"]

end

Gossip["Gossip Network<br/>t=0-0.5s"]

subgraph Branch["PHASE 2: Branching (t=0.5s)"]

Conflict{"Conflict<br/>Detection"}

Conflict -->|fee_rate conflict| ConflictBucket["Conflict Bucket:<br/>Branch A, Branch B"]

Conflict -->|no conflict| NonConflict["Non-Conflict:<br/>Branch C"]

end

PropA --> Gossip

PropB --> Gossip

PropC --> Gossip

Gossip --> Conflict

subgraph Validate["PHASE 3: Validation (t=1.0-5.0s)"]

ConflictBucket --> ValA["Validators replay Branch A<br/>ZK-SNARK attestation"]

ConflictBucket --> ValB["Validators replay Branch B<br/>ZK-SNARK attestation"]

NonConflict --> ValC["Validators replay Branch C<br/>ZK-SNARK attestation"]

end

subgraph VDFPhase["PHASE 4: VDF Tournament (t=5.5-7.0s)"]

ValA --> VDFA["VDF Race:<br/>isogeny_vdf 1.0s"]

ValB --> VDFB["VDF Race:<br/>isogeny_vdf 1.0s"]

Winner{"Earliest<br/>Output?"}

VDFB --> Winner

Winner -->|Branch A wins<br/>t=1.7s| WinA["Branch A Selected"]

Winner -->|Branch B loses<br/>t=1.72s| Slash["Slash Branch B<br/>Bond (DAO-configurable) to treasury"]

end

subgraph MergePhase["PHASE 5: Merge & Finality (t=7.0-10.0s[^finality])"]

WinA --> MergeOp["Merge Operation:<br/>Union winner + non-conflicts"]

ValC -->|Auto-merge| MergeOp

MergeOp --> NewRoot["New Merkle Root:<br/>merkle_root: 0xDEF..."]

NewRoot --> Quorum["Quorum Attestation<br/>≥2/3 validators sign"]

Quorum --> LocalFinal["Local Finality:<br/>t=~10s[^finality]"]

end

subgraph L1Anchor["PHASE 6: L1 Anchoring"]

LocalFinal --> Submit2["Submit to L1 Oracle"]

Submit2 --> L1Final["L1 Finality<br/>~13 min Ethereum"]

L1Final --> Rewards["Distribute Rewards:<br/>60% validators<br/>20% proposers<br/>20% treasury"]

end

L1Root -.->|snapshot| Conflict

Rewards -.->|update| L1Root

style ConflictBucket fill:#ef4444,color:#fff,stroke:#dc2626,stroke-width:3px

style NonConflict fill:#3b82f6,color:#fff,stroke:#2563eb,stroke-width:3px

style WinA fill:#22c55e,color:#fff,stroke:#16a34a,stroke-width:3px

style Slash fill:#dc2626,color:#fff,stroke:#991b1b,stroke-width:3px

style LocalFinal fill:#22c55e,color:#fff,stroke:#16a34a,stroke-width:4px

The global state S is a Merkle trie encoding DAO primitives. Proposals mutate S via deltas. Branches maintain local S' = apply(delta, snapshot(S)), with ancestry for git-like logs. Conflicts: |S'_A ∩ S'_B| > 0 (overlapping writes).

- Commits: Atomic units

{ parent_root, txs: [deltas], post_state_root (attested), vdf_input_hash (commit‑reveal seeded), commit_timestamp (logical) }. - Branches: DAG nodes chaining commits. Buckets group by state key (H(fee_rate) → [B_A, B_B]).

ZK-SNARK Attestations: A Novel Validation Primitive

Reacxion proofs are ZK‑SNARK‑based attestations (Groth16 or Bulletproofs) that prove computational integrity without requiring validators to post collateral for routine validation work. Fraud or mis‑attestation remains slashable via L1 disputes. Unlike stake‑locked PoS validation, attestations use:

- Merkle inclusion proofs of state transitions.

- A Groth16 ZK‑SNARK of valid transaction replay (see Section 3.2 pseudocode).

- Reputation‑weighted quorum signatures; fraud is slashable, honest competition is not.

Proving Time Benchmarks (Preliminary, Q1 2026 validation pending):

- CPU (32-core AMD EPYC): 8-12s per proof (estimated)

- GPU (NVIDIA RTX 4090): 1-2s per proof (estimated)

- v1.0 requirement: Validators MUST use GPU acceleration to meet sub-5s target

- Future work (v1.1): Explore proof aggregation to batch 10-20 proofs (amortized cost)

Cost Profile: Groth16 verification costs ~200-300k gas base on Ethereum (optimized implementations: ~100k with aggregation) as of 2025 [17,38], translating to ~$10-50/month baseline for moderate DAO activity (50-100 attestations/month at 5-10 gwei 2025 post-Dencun gas prices, $2000 ETH). Costs spike to $40-200/month during congestion (50-100 gwei). Post-Dencun blob data reduces L2 costs by 90%+ [cite ETH gas tracker]. Costs scale with proposal volume and gas market conditions. Example calculation: 100 proofs/month × 200k gas × 7 gwei × $2000 ETH / 1e9 gwei/ETH = $28/month baseline. Batching strategies can amortize expenses during congestion spikes (aggregating up to 10 proofs reduces per-proof cost by ~60-80%).

Table 2.3b: Gas Cost Scenarios (2025 Post-Dencun)

| Scenario | Gas Price | Monthly Cost (100 proofs) | Likelihood |

|---|---|---|---|

| Baseline | 5-10 gwei | $10-50 | 60% of time |

| Moderate | 25 gwei | $50-100 | 30% of time |

| Congestion | 100 gwei | $200-400 | 10% of time (NFT drops) |

Assumes: 200k gas/proof, ETH @ $2000, 100 proofs/month baseline

Table 2.3a: ZK Attestation Batching Trade-offs

| Batch Size | Gas Cost/Proof | Latency Overhead | Best Use Case |

|---|---|---|---|

| 1 (no batch) | 200-300k gas | 0s (immediate) | High-priority proposals, low congestion |

| 5 proofs | ~140k gas/proof | +0.2-0.3s | Moderate congestion (50-75 gwei) |

| 10 proofs | ~100k gas/proof | +0.4-0.5s | High congestion (>100 gwei), cost-sensitive DAOs |

Calculation example: 10-proof batch: Base 200k + (10 × 7k inputs) = 270k total / 10 = 27k incremental per proof. Overhead from aggregation verification: ~730k base / 10 = 73k + 27k = 100k effective per proof.

Dynamic Strategy: Validators auto-select batch size based on real-time L1 gas prices (via oracle). Default threshold: Batch ≥5 proofs when gas >75 gwei sustained for >30 minutes.

Congestion Mitigation: The protocol auto‑adjusts via an L1 gas price oracle:

-

Fee Scaling: Proposer fees increase when L1 gas exceeds thresholds (e.g., 2× at >100 gwei), compensating validators for higher operational costs.

-

Treasury Subsidy: During sustained congestion (>7 days above threshold), the treasury can subsidize validator earnings via circuit breakers (Section 4.4.1).

-

Batching: ZK attestations may be aggregated (e.g., up to 10 proofs/tx) during high‑gas periods to amortize costs, trading 0.2–0.5s added latency for cost stability.

Garbage Collection vs. Audit Trails: Pruned branches (losers of VDF races, or merged branches) are removed from active validator memory shortly after resolution to prevent state bloat. Their post‑state roots and ancestry references are archived on L1 (compact roots) and optionally on IPFS/Arweave (full history), enabling git‑like audits without requiring validators to store unbounded data.

- Proposers: DAO members (bonded) submit txs.

- Validators: Pledged nodes (100–500, rep-bootstrapped) validate subsets, run VDFs, attest merges.

- L1 Oracle: A smart contract on the anchor chain (Ethereum L1 or compatible L2) with three core functions:

- Root Registry: Stores canonical Merkle roots submitted by validators (timestamped, append-only log).

- Dispute Resolution: Accepts fraud proofs during a 10-minute challenge window; invalid proofs slash challenger bonds (2× to treasury).

- Reward Distribution: Triggers validator/proposer payouts upon finality (≥2/3 attestations + no valid challenges).

- Bootstrapping: Reputation seeded via L1 stake or DAO vouches (e.g., token-voted whitelists). In Phase 0 pilots (e.g., Grants DAO), we start with a curated set of 10–30 validators before expanding toward a 100–500 node permissionless set once economics and tooling are validated, with minimum hardware specs and client diversity.

- Join Flow: Submit on-chain intent with stake or voucher; complete a probation period (default P=7 days) with reduced selection weight; gain reputation via successful attestations.

- Exit Flow: Request exit with an unbonding delay (default U=24h). Pending disputes block exit. Reputation decays gracefully; keys rotated and archived.

- Churn Policy: Target weekly churn ≤10%. Selection randomization avoids centralization; uptime and liveness metrics recalibrate selection weights.

- Client Diversity (Ops Requirement): To prevent monoculture risks (e.g., consensus-layer bugs affecting all validators), the protocol incentivizes diversity via:

- Reputation Bonus: Validators running minority clients (e.g., <30% network share) receive +5% rep weight

- Target Mix: Ideal distribution: 40% Rust implementation, 40% Go implementation, 20% other (e.g., Typescript, C++)

- Monitoring: Validator client fingerprints (via user-agent in gossip messages) tracked on-chain for transparency

- Audit Requirement: Q1 2026 pilots (Target Partners; data published Q2 2026) will establish baseline client distributions and evaluate diversity incentives

- Hardware Requirements (v1.0):

Component Phase 0 (Pilot) Production (v1.0+) Notes CPU 16-core AMD Ryzen 9 32-core AMD EPYC VDF computation RAM 32GB DDR5 64GB DDR5 ECC ZK proof generation Storage 1TB NVMe SSD 2TB NVMe Gen4 State snapshots GPU Optional Required (RTX 4090 / A6000) Mandatory for sub-5s ZK proving - Rationale: Ethereum's Merge highlighted monoculture risks (Prysm dominance). Reacxion proactively diversifies to avoid consensus failures from single-client bugs.

- Misbehavior: Slash per DAO policy (bond + rep penalty) for fraud or repeated failures; temporary suspensions for high error rates.

- Quorum Computation: Attestation quorums are computed over the active validator set, maintaining ≥2/3 signatures for local finality.

- Key Rotation (Ops Note): Validators rotate keys on a 90‑day schedule; ECDSA keys use standard HD derivation with hardware wallets/HSMs, BLS keys follow operator guidance for secure aggregation and domain‑tagging; rotations are announced on‑chain and cross‑checked via quorum bitmap updates.

Reacxion's ≤20% Byzantine tolerance is a deliberate design trade-off prioritizing sub-second throughput and liveness for governance applications, where temporary stalls are acceptable but safety (no double-spends, persistent forks) must be absolute. This 20% threshold aligns with Tier 1 security requirements (Section 1.3). We assume adaptive adversaries controlling ≤20% of validators (by stake/rep). This threshold is intentionally conservative compared to traditional BFT (33%) or Nakamoto (51%) for three reasons:

- Speed-Security Tradeoff: Higher Byzantine tolerance requires larger quorums (e.g., ≥2/3 attestation), increasing gossip overhead. For sub-second local finality, we optimize parallelism and gossip paths while maintaining ≥2/3 quorum.

- Economics of Attack: At 20% control, grinding attacks cost >1000x honest compute (Section 5.3.1), making them unprofitable below $10M TVL. At 33%, this drops to ~100x, lowering the attack barrier. ASIC development becomes profitable at $50M+ TVL (Section 5.5.2b).

- Target Use Case: Mid-scale DAOs ($1M-50M TVL) face lower adversarial pressure than L1 chains. For high-value governance (>$50M), we recommend hybrid approaches or L1-only governance due to ASIC risk.

Byzantine Tolerance Comparison:

| Protocol | Byzantine Tolerance | Justification | Use Case Fit |

|---|---|---|---|

| Traditional BFT (PBFT) | 33% | General-purpose consensus | High-value L1 chains |

| Nakamoto (Bitcoin) | 51% | Economic security via PoW | Store of value |

| Reacxion v1.0 | 20% | Speed-optimized governance with L1 fallback | Tier 1 DAO params (<$10M) |

Degradation Beyond 20%:

- 20-33%: Liveness may degrade (VDF tournaments delay >10s); safety preserved—no double-spends or persistent forks, as the L1 oracle rejects invalid roots. Network recovers via timeouts, re-broadcasts, and validator reputation penalties.

- 33-51%: Liveness at high risk (quorum failures possible); L1 fallback governance activates automatically to ensure progress.

- >51%: Security model breaks; DAO must migrate to L1-only governance via emergency multisig.

This threshold aligns with asynchronous BFT bounds [19], where ≤20% adversarial control makes grinding attacks unprofitable (>1000x honest compute cost; see Section 5.3.1). Unlike synchronous BFT systems requiring 33% tolerance, our design optimizes for speed-first governance with L1-anchored safety guarantees. See Section 5.3.1 for the detailed grinding cost proof.

This section instantiates the high-level pipeline from Section 2.1 as concrete state transitions: from proposal submission and bucketing, through validation and VDF conflict resolution, to merge, local finality, and L1 anchoring.

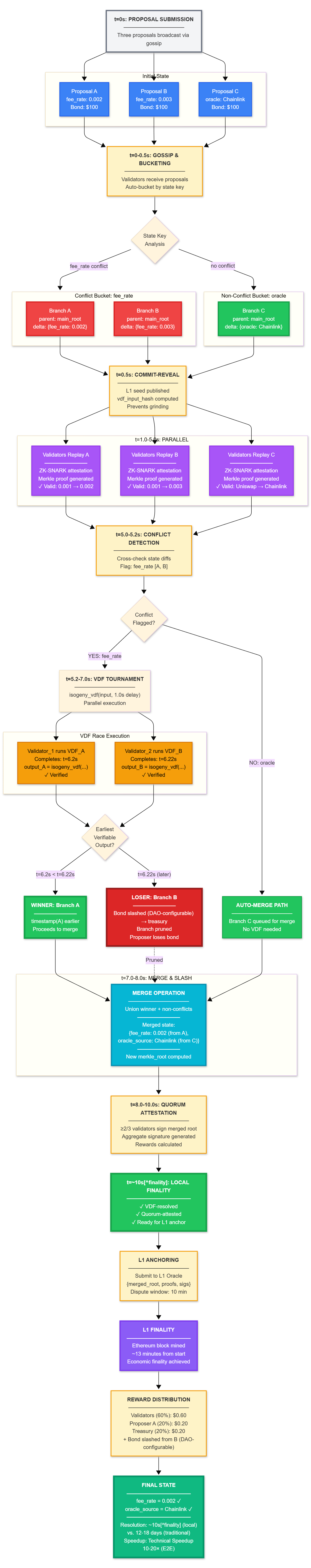

Figure 3.1: End-to-End Proposal Lifecycle

%%{init: {'theme':'base', 'themeVariables': { 'fontSize':'13px', 'fontFamily':'arial'}}}%%

graph TB

Start["<b>t=0s: PROPOSAL SUBMISSION</b><br/>────────────────<br/>Three proposals broadcast via gossip"]

subgraph Proposals["Initial State"]

PropA["Proposal A<br/>fee_rate: 0.002<br/>Bond: $100"]

PropB["Proposal B<br/>fee_rate: 0.003<br/>Bond: $100"]

PropC["Proposal C<br/>oracle: Chainlink<br/>Bond: $100"]

end

Start --> PropA

Start --> PropB

Start --> PropC

Gossip["<b>t=0-0.5s: GOSSIP & BUCKETING</b><br/>────────────────<br/>Validators receive proposals<br/>Auto-bucket by state key"]

PropA --> Gossip

PropB --> Gossip

PropC --> Gossip

Gossip --> Bucket{State Key<br/>Analysis}

subgraph ConflictBucket["Conflict Bucket: fee_rate"]

BranchA["Branch A<br/>parent: main_root<br/>delta: {fee_rate: 0.002}"]

BranchB["Branch B<br/>parent: main_root<br/>delta: {fee_rate: 0.003}"]

end

subgraph NonConflictBucket["Non-Conflict Bucket: oracle"]

BranchC["Branch C<br/>parent: main_root<br/>delta: {oracle: Chainlink}"]

end

Bucket -->|"fee_rate conflict"| ConflictBucket

Bucket -->|"no conflict"| NonConflictBucket

CommitReveal["<b>t=0.5s: COMMIT-REVEAL</b><br/>────────────────<br/>L1 seed published<br/>vdf_input_hash computed<br/>Prevents grinding"]

BranchA --> CommitReveal

BranchB --> CommitReveal

BranchC --> CommitReveal

subgraph Validation["t=1.0-5.0s: PARALLEL VALIDATION"]

ValA["Validators Replay A<br/>━━━━━━━━<br/>ZK-SNARK attestation<br/>Merkle proof generated<br/>✓ Valid: 0.001 → 0.002"]

ValB["Validators Replay B<br/>━━━━━━━━<br/>ZK-SNARK attestation<br/>Merkle proof generated<br/>✓ Valid: 0.001 → 0.003"]

ValC["Validators Replay C<br/>━━━━━━━━<br/>ZK-SNARK attestation<br/>Merkle proof generated<br/>✓ Valid: Uniswap → Chainlink"]

end

CommitReveal --> ValA

CommitReveal --> ValB

CommitReveal --> ValC

ConflictDetect["<b>t=5.0-5.2s: CONFLICT DETECTION</b><br/>────────────────<br/>Cross-check state diffs<br/>Flag: fee_rate [A, B]"]

ValA --> ConflictDetect

ValB --> ConflictDetect

ValC --> ConflictDetect

ConflictDetect --> Decision{Conflict<br/>Flagged?}

Decision -->|"YES: fee_rate"| VDFTournament["<b>t=5.2-7.0s: VDF TOURNAMENT</b><br/>────────────────<br/>isogeny_vdf(input, 1.0s delay)<br/>Parallel execution"]

Decision -->|"NO: oracle"| AutoMerge["<b>AUTO-MERGE PATH</b><br/>────────────────<br/>Branch C queued for merge<br/>No VDF needed"]

subgraph VDFRace["VDF Race Execution"]

VDFA["Validator_1 runs VDF_A<br/>Completes: t=6.2s<br/>output_A = isogeny_vdf(...)<br/>✓ Verified"]

VDFB["Validator_2 runs VDF_B<br/>Completes: t=6.22s<br/>output_B = isogeny_vdf(...)<br/>✓ Verified"]

end

VDFTournament --> VDFA

VDFTournament --> VDFB

VDFA --> Compare{Earliest<br/>Verifiable<br/>Output?}

VDFB --> Compare

Compare -->|"t=6.2s < t=6.22s"| WinnerA["<b>WINNER: Branch A</b><br/>━━━━━━━━<br/>timestamp(A) earlier<br/>Proceeds to merge"]

Compare -->|"t=6.22s (later)"| LoserB["<b>LOSER: Branch B</b><br/>━━━━━━━━<br/>Bond slashed (DAO-configurable) → treasury<br/>Branch pruned<br/>Proposer loses bond"]

subgraph MergePhase["t=7.0-8.0s: MERGE & SLASH"]

MergeOp["<b>MERGE OPERATION</b><br/>────────────────<br/>Union winner + non-conflicts<br/>━━━━━━━━<br/>Merged state:<br/>{fee_rate: 0.002 (from A),<br/>oracle_source: Chainlink (from C)}<br/>━━━━━━━━<br/>New merkle_root computed"]

end

WinnerA --> MergeOp

AutoMerge --> MergeOp

LoserB -.->|"Pruned"| MergeOp

QuorumAttest["<b>t=8.0-10.0s: QUORUM ATTESTATION</b><br/>────────────────<br/>≥2/3 validators sign merged root<br/>Aggregate signature generated<br/>Rewards calculated"]

MergeOp --> QuorumAttest

LocalFinal["<b>t=~10s[^finality]: LOCAL FINALITY</b><br/>━━━━━━━━━━━━<br/>✓ VDF-resolved<br/>✓ Quorum-attested<br/>✓ Ready for L1 anchor"]

QuorumAttest --> LocalFinal

L1Anchor["<b>L1 ANCHORING</b><br/>────────────────<br/>Submit to L1 Oracle<br/>{merged_root, proofs, sigs}<br/>Dispute window: 10 min"]

LocalFinal --> L1Anchor

L1Final["<b>L1 FINALITY</b><br/>━━━━━━━━━━━━<br/>Ethereum block mined<br/>~13 minutes from start<br/>Economic finality achieved"]

L1Anchor --> L1Final

Rewards["<b>REWARD DISTRIBUTION</b><br/>────────────────<br/>Validators (60%): $0.60<br/>Proposer A (20%): $0.20<br/>Treasury (20%): $0.20<br/>+ Bond slashed from B (DAO-configurable)"]

L1Final --> Rewards

End["<b>FINAL STATE</b><br/>━━━━━━━━━━━━<br/>fee_rate = 0.002 ✓<br/>oracle_source = Chainlink ✓<br/>━━━━━━━━━━━━<br/>Resolution: ~10s[^finality] (local)<br/>vs. 12-18 days (traditional)<br/>Speedup: Technical Speedup<br/>10-20× (E2E)"]

Rewards --> End

style Start fill:#f3f4f6,stroke:#6b7280,stroke-width:3px

style PropA fill:#3b82f6,stroke:#2563eb,stroke-width:2px,color:#fff

style PropB fill:#3b82f6,stroke:#2563eb,stroke-width:2px,color:#fff

style PropC fill:#3b82f6,stroke:#2563eb,stroke-width:2px,color:#fff

style BranchA fill:#ef4444,stroke:#dc2626,stroke-width:3px,color:#fff

style BranchB fill:#ef4444,stroke:#dc2626,stroke-width:3px,color:#fff

style BranchC fill:#22c55e,stroke:#16a34a,stroke-width:3px,color:#fff

style ValA fill:#a855f7,stroke:#9333ea,stroke-width:2px,color:#fff

style ValB fill:#a855f7,stroke:#9333ea,stroke-width:2px,color:#fff

style ValC fill:#a855f7,stroke:#9333ea,stroke-width:2px,color:#fff

style VDFA fill:#f59e0b,stroke:#d97706,stroke-width:2px,color:#000

style VDFB fill:#f59e0b,stroke:#d97706,stroke-width:2px,color:#000

style WinnerA fill:#22c55e,stroke:#16a34a,stroke-width:4px,color:#fff

style LoserB fill:#dc2626,stroke:#991b1b,stroke-width:4px,color:#fff

style AutoMerge fill:#22c55e,stroke:#16a34a,stroke-width:2px,color:#fff

style MergeOp fill:#06b6d4,stroke:#0891b2,stroke-width:3px,color:#fff

style LocalFinal fill:#22c55e,stroke:#16a34a,stroke-width:4px,color:#fff

style L1Final fill:#8b5cf6,stroke:#7c3aed,stroke-width:3px,color:#fff

style End fill:#10b981,stroke:#059669,stroke-width:4px,color:#fff

style Gossip fill:#fef3c7,stroke:#f59e0b,stroke-width:2px

style CommitReveal fill:#fef3c7,stroke:#f59e0b,stroke-width:2px

style ConflictDetect fill:#fef3c7,stroke:#f59e0b,stroke-width:2px

style QuorumAttest fill:#fef3c7,stroke:#f59e0b,stroke-width:2px

style L1Anchor fill:#fef3c7,stroke:#f59e0b,stroke-width:2px

style Rewards fill:#fef3c7,stroke:#f59e0b,stroke-width:2px

Figure 3.1: Proposal lifecycle. The diagram shows three proposals (A, B, C), where A and B conflict and C is non-conflicting. The flow matches the pipeline in Section 2.1: submission and gossip, bucketing, validation, VDF tournament for conflicts, merge, local finality, and L1 anchoring.

| Phase | Actions | State Transition | Time | Notes |

|---|---|---|---|---|

| Submission | Proposer broadcasts tx | Queued in gossip pool | t=0 | ¹ |

| Gossip & Bucket | Validators auto-bucket by key | Branches forked, bucketed | t=0-0.2s | ² |

| Commit-Reveal | Reveal vdf_input_hash | Commits locked | t=0.2s | ³ |

| Initial Validation | Replay txs, attest | Branches validated or flagged | t=0.2-0.5s | ⁴ |

Notes:

¹ Bond fail: tx drops, rep -1%. Network partition: L1 fallback (+5s). Visibility window enforced: min_gossip_period before VDF tournaments (default 24h).

² Gossip stall: re-broadcast. Capacity overflow: drop lowest-rep tx.

³ Reveal mismatch: auto-slash bond. Seed source: L1 seed = H(recent_L1_block_hash || epoch_id), sourced from the latest Ethereum block at commit time to resist grinding. Seed delay: per-validator clock sync (NTP required).

⁴ Replay fail: quorum reject, proposer slash. Low attest: extend gossip.

Key Algorithms (Pseudocode):

ZK-SNARK Attestation Generation:

function generate_zk_attestation(tx, state_snapshot):

pre_state = state_snapshot

post_state = apply_transaction(tx, pre_state)

merkle_path = compute_merkle_path(pre_state.root, post_state.root)

zk_proof = groth16_prove(tx, pre_state, post_state) // ZK proof of valid transition

signature = sign(H(tx, post_state.root), validator_key)

return { merkle_root: post_state.root, zk_proof, signature }

VDF Tournament Execution:

function vdf_tournament(conflicting_branches, seed):

// log(N) rounds tournament; seed = H(recent_L1_block_hash || epoch_id)

// Inputs include commit-reveal hashes to prevent grinding

winners = deterministic_shuffle(conflicting_branches, seed)

while len(winners) > 1:

// Pair up, run parallel VDFs (~1s delay) with attested inputs

// Earliest verifiable output wins, loser bond slashed (DAO-configurable)

winners = run_next_round(winners)

// Return attested winner for quorum signature aggregation (≥2/3)

return winners[0]

Scaling Analysis: For N=100 conflicting branches:

- Tournament rounds: ⌈log₂(100)⌉ = 7 rounds

- Per-round breakdown:

- VDF computation: 1.0s (sequential, isogeny-based)

- Gossip output + verify: 0.3s (200ms gossip + 100ms verification)

- Next-round setup: 0.2s (re-pair winners, broadcast inputs)

- Total per round: 1.5s

- Worst-case 100-branch conflict: 7 rounds × 1.5s = 10.5s This remains orders‑of‑magnitude faster than traditional DAO resolution on the technical execution path. For smaller conflicts (2-10 branches), resolution completes in ~5-10s (dominated by ZK proving time), achieving our median local finality target. Assumptions: ≤10 branches per conflict bucket (typical for param tweaks), network latency Δ≈200ms, and VDF hardware advantage ≤3× per benchmarks [18]. Scales log(N) to ~10.5s for 100 branches.

| Phase | Actions | State Transition | Time | Notes |

|---|---|---|---|---|

| Replay & Proof | Validators replay txs, generate ZK attestation | Proof attached to branch | t=1.0-5.0s | ¹ |

| Conflict Flag | Cross-check diffs, flag conflicts | Conflicts escalated to VDF | t=5.0-5.2s | ² |

| VDF Race | Run VDF tournament on conflicting branches | Outputs collected, winner advances | t=5.2-7.0s | ³ |

| Merge & Slash | Union winner delta w/ non-conflicts, slash losers | Main state updated, loser pruned | t=7.0-8.0s | ⁴ |

Notes:

¹ Replay diverge: proposer slash. Compute fail: delegate or face rep penalty.

² False positive: re-scan with L1 root. Gossip loss: randomized re-confirmation.

³ Verif fail: reject & slash. Tie: Deterministic hash lottery: winner = H(output_A || output_B) % 2 (avoids L1 timestamp manipulation by miners/sequencers). L1 timestamp used only as final fallback if outputs are bit-identical (astronomically rare).

⁴ Merge conflict post-VDF: winner overwrites. Slash dispute: L1 fraud proof.

| Phase | Actions | State Transition | Time | Notes |

|---|---|---|---|---|

| Anchor Submit | L1 proposer submits merged root | L1 mempool queued | t=1.5s | ¹ |

| Quorum Attest | ≥2/3 validators attest root, rewards distributed | Attested root, rewards vested | t=1.6-2.0s | ² |

| Phase | Action | Outcome | Timing | Notes |

| ------------ | ------------ | ------------- | ------------ | ----------- |

| Dispute Resolution | Challenger submits fraud proof (10 min window) | State is final or reverted | t=2.1s (Local Finality: L2 quorum-attested); L1 Economic Finality: +10-30s (L2 anchors) or ~13 min (Ethereum L1, depends on block timing/congestion) | ³ |

Notes:

¹ L1 congestion: delay queue. Invalid root: proposer slash.

² Low attest: re-submit with incentives. Reward dispute: L1 fraud proof.

³ False claim: challenger slash. L1 fork: re-attest on longest chain.

- Aggregate Signature (Default: ECDSA M-of-N): Default ECDSA multisig with a quorum bitmap over validator indices; BLS12‑381 aggregate signatures (G1) are supported as an optimization on chains with pairing precompiles.

- Threshold: ≥2/3 of active validator set (DAO-configurable).

- Verification (ECDSA): Each signature verifies over the attestation payload hash; the contract checks bitmap cardinality and validates M signatures out of N active validators.

- Verification (BLS): Aggregate signature over attestation payload hash with domain separation; bitmap indicates participating validator indices; single on-chain pairing check.

- Domain Separation: Use context tag "REACXION_ATTESTATION_V1" and hash function keccak256 for payload hashing; when using BLS, apply hash‑to‑curve with expand_message_xmd(SHA‑256) and the domain tag to avoid cross‑protocol signature reuse.

- Attestation Payload Schema:

parent_root: bytes32merged_root: bytes32branch_ids: uint64[] (identifiers for merged branches)post_state_root: bytes32 (attested)vdf_outputs: bytes[] (per-branch or per-round outputs)commit_reveal_hashes: bytes32[] (anti-grinding inputs)zk_proof: bytes (Groth16 proof)commit_timestamp: uint64 (logical)attester_id: bytes20 (validator ID)

- Anchor Submit Message:

- ECDSA default:

{ merged_root, payloads: [AttestationPayload], quorum_signatures: ECDSA[], quorum_bitmap } - BLS optimization:

{ merged_root, payloads: [AttestationPayload], quorum_signature: BLSAggSig, quorum_bitmap } - On-chain contract verifies payload consistency, quorum threshold, and signatures per selected scheme.

- ECDSA default:

- On-chain Contract Interface (Sketch):

function submitAnchor(bytes32 merged_root, AttestationPayload[] payloads, bytes quorumBitmap, SignatureBundle sigs)function submitDispute(bytes32 contested_root, FraudProof proof, Bond deposit)function resolveDispute(bytes32 contested_root)function finalize(bytes32 merged_root)- Where

SignatureBundleis either{ ECDSA[] sigs }or{ BLSSig sig }, andFraudProofcarries the evidence schema noted above.

- Selection: The contract auto-selects the

SignatureBundlevariant based on the DAO parametersignature_scheme(Section 4.5) or chain capability detection (use BLS when pairing precompiles exist); operators can override via governance.- Example values:

signature_scheme = "ecdsa" | "bls". - Gas-cost trade-offs (indicative): ECDSA M-of-N scales linearly with M signatures; BLS reduces verification to a single pairing check but requires pairing precompiles; choose based on chain support and expected validator counts.

- Example values:

- Who Can Challenge: Any validator or DAO member meeting anti-griefing bond requirements.

- Anti-Griefing Bond: Default $100 or 1% of proposal value (DAO-configurable); refunded if challenge succeeds; slashed 2× to treasury if frivolous.

- v1.1 Adaptive Schedule: Bond scales with historical frivolous challenge rate (e.g., base × (1 + r × k)), where r is the last 30‑day frivolous rate and k is a DAO‑set sensitivity (0.5–2.0); cool‑down reduces back to base after 14 days with r→0.

- Challenge Window: 10 minutes (DAO-configurable to 5–30 minutes). Contract states: Pending → Challenged → Resolved.

- Fraud Proof Message: